CPI's Impact on Stocks, and How People Get Confused [re-post]

The press reports CHANGE in CPI, but CPI itself is a much bigger number. It’s confusing, we know.

Keep an eye on the market tomorrow, 03/10, for CPI’s impact on the market as it’s released.

As long as change in CPI-U isn’t anything well above 1.0%, the market should be fine.

We’ll explain CPI in a sec.

The point of this piece is make sure that you never say something like “CPI is 0.3”.

As we’ll repeat multiple times here, people who say this are likely referring to the month-over-month change in CPI and not CPI itself.

The BLS reports the change in CPI, then it gets spread as just CPI across news outlets and uninformed

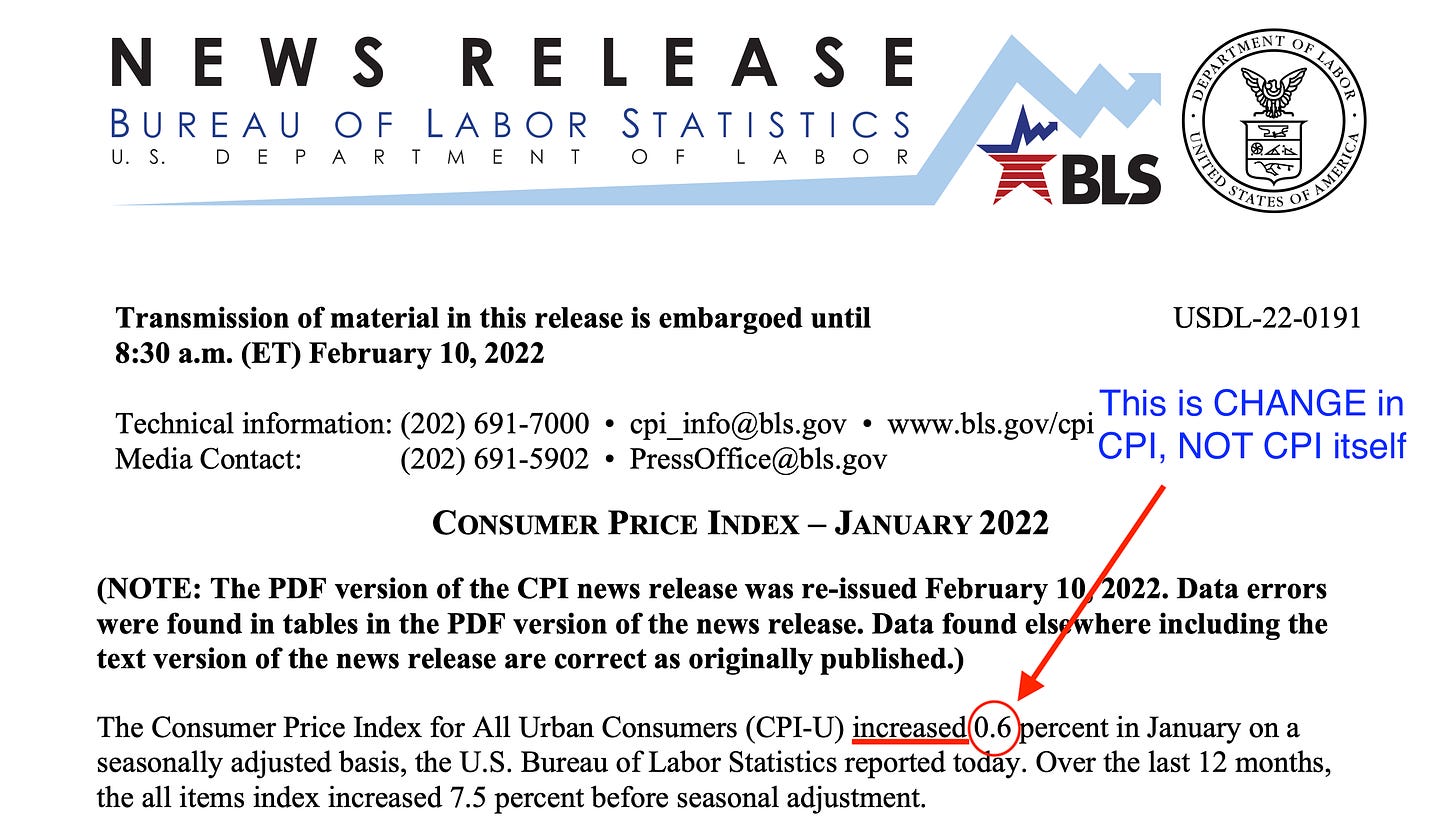

See the number, circled red, in the image below?

That number is called the change in CPI-U. It’s also acceptable to call it the “inflation rate”, or change in CPI.

That number is not CPI or CPI-U. CPI itself has been above 200-something for over a decade.

We can’t have our readers talking like this.

CPI is the Consumer Price Index; it’s a general measure of change in price of goods and services in an economy.

CPI (often synonymous with “inflation”) is a number that represents the change in prices of some “basket of goods” and is supposed to represent the prices of certain essential and non-essential things in an economy.

The BLS reports changes in CPI-U on the 10th of every month. CPI-U is CPI but for the “Urban Consumer,” or a price index representing goods and services that people in an urban or urban metro-area would consume.

CPI gives the Fed a reason to change the price of nearly free loans, aka Federal Funds Rate.

Sadly, that’s the gist CPI’s significance to the market right now. Investors want a status update on when the price of nearly free loans will increase. So everyone’s listening. They just want to know when to stop being super greedy — that’s pretty much it.

Investors have been given a lot of cheap loans (low interest rate bonds) as a result of their Quantitative Easing (QE) policy shift at the beginning of the pandemic in order to make sure banks have enough cash to cover their butts amidst a shaky pandemic economy. Now that we’ve clearly progressed from the Significant inflation metrics like CPI are used to make decisions about interest rates (read: prices) about the price of those loans.

What is the Federal Funds Rate?

It’s the interest rate that the Fed allows banks to charge other banks for loans.

This rate constrains the interest rates set on loans by banks, financial institutions, and other lenders in the market. It also impacts other important financial payments, like the following:

mortgages

the APY on credit cards

the interest you can earn in a savings account

For a more technical definition we refer to the Federal Reserve Economic Data website, aka FRED,

“The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight.

When a depository institution has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with excess cash, which is often referred to as liquidity, will lend to another bank that needs to quickly raise liquidity. ”

The press reports CHANGE in CPI, but CPI itself is a much bigger number. It’s confusing, we know.

THIS is NOT CPI itself, as indicated by the word “increased”.

The photo above is a Bureau of Labor Statistics document about CPI that begins by stating the CHANGE in CPI. For some reason this number gets muddled with CPI itself in conversations though.

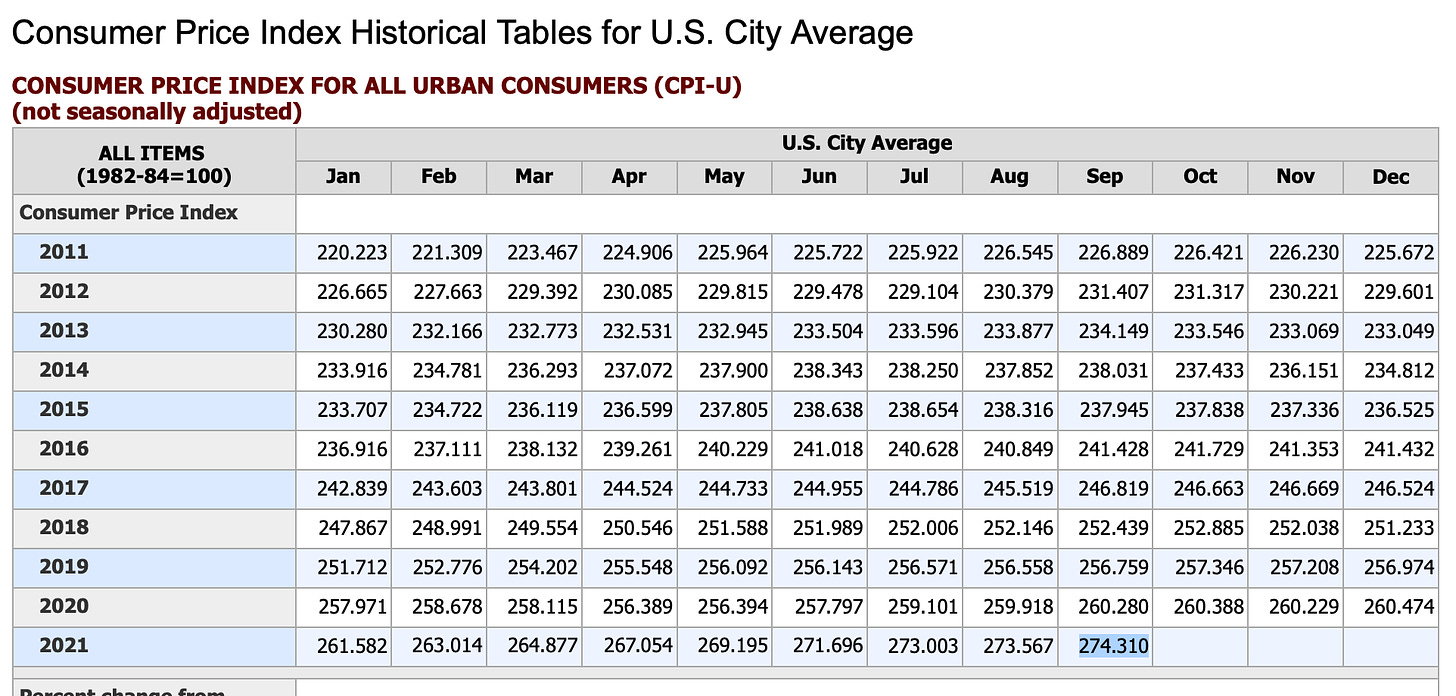

THIS is CPI.

CPI reports and readings are unnecessarily confusing. Every month there’s a new CPI report, and the media and investors say “CPI” when they mean change in CPI.

The news always reports a number like 0.2 or 0.5, but this is actually the percent change in CPI since the last report in the previous month. These numbers are NOT CPI. CPI is much bigger as you just saw.

It’s also annoying that they don’t use the percentage symbol next to it. This leads people to say things like “CPI was 0.3 last month”, which is false on two levels: first, CPI isn’t 0.3, and second, that “0.3” is likely the percentage change in CPI. We digress.

Anyways, CPI is a much bigger number, and has been above 200-something for a while. Don’t get it confused with the change in CPI that we always see.

Very well written, Justo. I'm an economics ignoramus, so I still don't understand it all. But you're helping to get me there. Keep up the good work.