No Catalyst Calendar This Month

Nothing will make the market much more turbulent than it already is except maybe CPI, sort of.

No Catalyst Will Change the Market’s Behavior in May

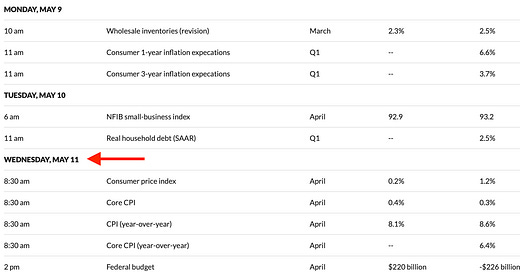

There are some inflation-related and job-related catalysts that might make the market a bit more crazy than we’ve been seeing, but not by that much. The biggest thing is CPI, which will be announced Wednesday.

The forecasts of CPI are all absurdly lower than I would expect almost as if analysts and economists want to give the market a reason to sell off.

All we need to know is that, if we do get some scary CPI data the impact will be temporary if it has any.

The biggest question on everyone’s mind is whether we’re at a “bottom”; I don’t think so.

I’ll post something later this week on my opinion on whether or not we’ll go into a recession. In general, I don’t think we will. However, we could enter a “technical” recession,