WC-10/27: Expect a Bad Week

Indicators are down. Also, the first catalyst(s) in a while.

Expect A Bad Week

The market had a bad week last week, as predicted, posting losses of 0.85%. Expect more of the same this week: the RSI is still in the middle to over-bought range, and the McClellan looks to be doing more of the same. That said, there are some catalysts to pay attention to.

S&P 500 RSI: 65.35 and floating

Like I predicted last week, the RSI pretty much stayed in the same place: slightly over-bought, but not in the position to suggest any incoming reversals. The RSI has been behaving like this for the past two weeks at this point, and it’s likely to continue until after the election.

Pretty much, don’t expect anything groundbreaking; if anything the RSI and the market might diverge (moving down and maintaining the status quo, respectively) a bit as investors try to avoid exposure to the election.

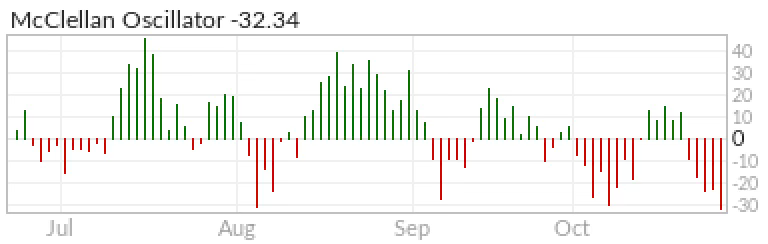

McClellan Oscillator (S&P 500): -32.34 and falling

The McClellan did, in fact, go somewhere last week, but the market didn’t follow, with the McClellan losing about 50 points and the market only moving by 0.85%. This is a teachable moment: use more than one indicator.

Broadly, the McClellan moving significantly more than the market suggests that medium and small-cap stocks, which are weighted equally to large-caps, are struggling while real market movers are doing just fine. This fits with the election-exposure hypothesis: investors are limiting exposure to smaller stocks that are more likely to be affected by election outcomes.

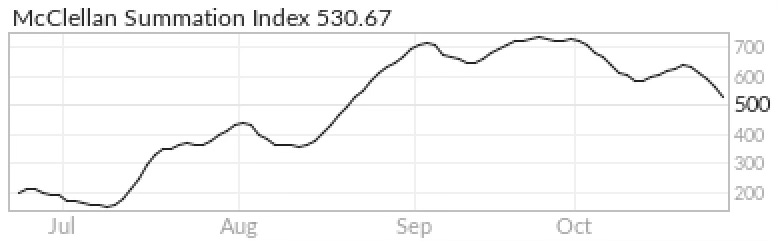

MSI (S&P 500): 530.67 with negative momentum

The MSI is showing some negative momentum for this week which, if anything, is getting stronger. This supports the losses hypothesis for this week. That said, it’s approaching 500, so a change in momentum is possible soon.

This Week’s Market Catalysts: Earnings and Jobs

There are a couple earnings and jobs reports coming out this week. I’ll list them and their effects here (briefly). These won’t make or break the stock market, but they’re good for grown (if projections are accurate):

Tuesday

Alphabet (GOOGL)

Will likely post earnings growth. Expect gains on anticipation and if growth is greater than expected.

Wednesday

Meta (META)

Will likely post significant—18 percent—earnings growth. Expect gains on anticipation and if growth is greater than expected.

GDP data

Continuing GDP growth of about 3 percent is expected. Good for the market for obvious reasons. This is more important for the overall market than corporate earnings, too.

Thursday

Apple (APPL)

Apple is, like others, likely to post growth. They’ve also beat earnings expectations for the past three quarters. Expect growth, especially if they beat expectations again.

Amazon (AMZN)

Pretty much the same as Apple. Tech companies are doing very well.

Core PCE data

This is another inflation measure like CPI, but it’s preferred by the Fed for several reasons. An annual inflation rate of 2.6 is expected, which would be 0.1 lower than last month and more proof of a soft landing.