Expect a Good Week

Newsletter’s short this week. Basically, indicators are looking primed for growth, but uncertainty around the election could hamper that.

S&P 500 RSI: 31.44 and on the up

The RSI is finally in an oversold condition, meaning that it’s ready to come back up. It was floating in the overbought condition (around 70) for a while before this. TLDR, the RSI is predicting growth in the market.

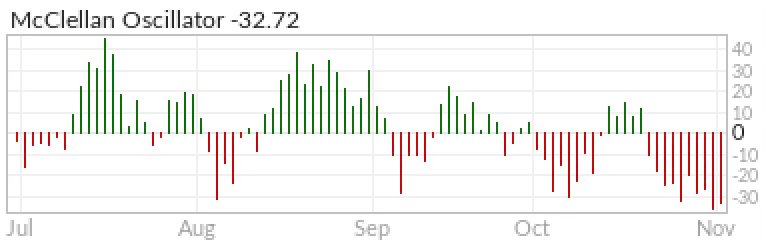

McClellan Oscillator (S&P 500): -32.72 and rising

While it looks like the McClellan didn't go anywhere last week from the numbers alone, it’s possible to make out some trends that suggest growth this week. See the arrows on the second chart.

The McClellan and RSI are in agreement that there will be growth this week. That’s predicated on the market acting normally, which is not a given in an election week.

MSI (S&P 500): 388.12 and oversold

The MSI is, like the RSI, in an oversold condition, since, in the MSI’s case, it’s below 400. This is the third signal that this week will be good for the market.

This Week’s Market Catalysts: Election

While election’s don’t necessarily affect the long term outlook for the stock market, uncertainty is bad for the market in the short and medium terms. The election, especially with threats of violence and challenges to results, represents a huge source of uncertainty for all investors.