Expect a Mild Week

The market spiked last week on the results of the Election and is now leveling out. Expect this behavior to continue through the week as the market trends back to a more normal growth rate.

S&P 500 RSI: 63.69 and leveling out

The RSI had begun to fall before the election last week, nearing 30, before being pushed back up to around 60 by the election. It’s had a habit of hovering around slightly overbought (see the behavior around 3/20 below for an example), so expect this to continue as it trends back down.

Like with the behavior around 3/20, expect oscillation with a downward trend before beginning the cycle anew.

McClellan Oscillator (S&P 500): 10.61 and rising

The McClellan, like the RSI, made a big jump on Election Day, but it’s only barely over 0, unlike the RSI, which is nearing overbought territory. This lends credence to the float back to normalcy theory.

Expect the McClellan to creep up as the RSI hovers, before they fall back down together.

MSI (S&P 500): 380.28 and oversold

While the MSI is actually lower than it was last week, it now has an upward trend, albeit a weak one. It’s still in oversold territory, at least for the near term: the MSI has actually been in the positive for the past year or so. When I say that the MSI is oversold, I mean that it’s low relative to the recent average. TLDR, the MSI is predicting mild growth.

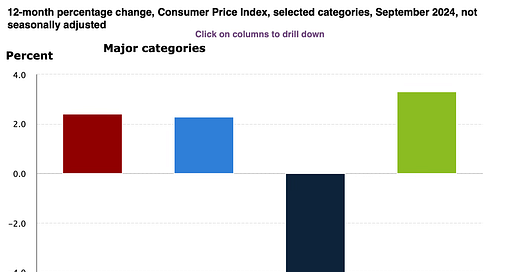

This Week’s Market Catalysts: CPI and PPI

Not a catalyst, but there’s CPI and PPI data coming out on Wednesday, November 13, and Thursday, November 14, respectively. It’s looking like inflation will be slightly—0.1% year-over-year—higher than last month, at least according to CPI. This isn’t reflected in Core CPI, though. Expect negative market reactions if the CPI or PPI are significantly higher than expected, and vice versa if they’re lower.